Keep Scrolling

I am once again happy to provide our annual Investment Stewardship Report. As you may remember, we adopted a stewardship approach last year to broaden what was a discussion of sustainability into a broader discussion of risk. We have defined investment stewardship as “the responsible allocation, management and oversight of our capital to creating value for our stakeholders,” and I can confirm that this approach remains unchanged.

I want to be clear that specific sustainability-related risks remain important to our overall business and that we will continue to address those risks through mitigation and management.

The key risks in this report are unchanged from last year, and we remain committed to the Vision, Mission and Core Values that we adopted four years ago. I can also assure you that the skill with which we identify, manage and mitigate risk in our business is matched by the excellent oversight of those risks by our Board. We believe our Board has the requisite experience and skill base to provide such oversight.

While a broader discussion of risk is included in this report, I will highlight two areas that were prominent for us during the year. In the area of economic factors and metal prices, we saw a substantial positive movement in the price of gold and silver. The average price of those metals increased 22.9% and 21.1% to $2,386/ounce and $28.27/ounce, respectively, from 2023 to 2024. Central bank purchases, lower interest rates and political upheaval and unrest, including the U.S. election, all contributed to the notable increases in precious metal prices. While metal prices increased, we did not see the same flow-through of demand for gold equities during the year. We continue to seek new potential investors in Royal Gold and believe that a focus on our business fundamentals, namely exceptional investment opportunities and sound financials, will attract those investors.

The other area of focus is leverage and liquidity. The higher metal prices improved our cash flows, and we were able to fully repay the outstanding balance under our revolving credit facility in August 2024. If you recall, we financed more than $900 million of acquisitions in 2022 through the use of cash on the balance sheet, cash from operations and our debt facility. At the beginning of 2023, we had $575 million outstanding under our revolving credit, and we paid back that amount in approximately 18 months. Our shareholders suffered no dilution through an equity raise, and there are already indications that the upside in those acquisitions is emerging. We paid approximately $105 million in dividends during 2024 and increased the dividend for calendar 2025 to $1.80/share. We have paid a dividend since 2000 and increased it for 24 consecutive years.

We have replenished our liquidity available for future acquisitions and are well positioned to pursue future non-dilutive opportunities.

In terms of sustainability, our due diligence and portfolio monitoring seeks to identify key environmental risks, including the impact to air, water and biodiversity, and our process also involves an assessment of the impact of projects on the communities around them. We also have remained active in helping develop the next generation of mining professionals through various scholarships at five universities and colleges, and we have remained supportive of efforts in our local communities to address food insecurity and healthcare.

I hope you find this report informative in terms of our risk management efforts. We always welcome comments and questions, and we look forward to keeping you updated on our progress in certain areas over the course of the year.

On behalf of the Board of Directors, I am pleased to present our 2024 Investment Stewardship Report, a reflection of our ongoing commitment to risk management across our business, including responsible mining and environmental stewardship, which plays a valuable role in creating value for our stakeholders.

We recognize the importance of balancing economic growth with sustainability. Our commitment to these principles is not only critical to maintaining the trust of our investors, employees, Operators and communities but also essential to positioning our portfolio for long-term success in a rapidly evolving global landscape.

We are proud of the significant progress we have made in our disclosures of the environmental footprints of the Operators, promoting transparent and ethical governance and contributing to sustainability-related projects that are positive and beneficial to our communities. We continue to support initiatives focused on healthcare, education and local employment. Through partnerships with local stakeholders, we aim to foster sustainable development and create lasting positive impacts.

Transparency and integrity remain at the core of our business model. In 2024, we enhanced our reporting practices by publishing our first Climate Report and Asset Handbook. Both of these important disclosures demonstrate our long-standing commitment and accountability to our stakeholders.

While we are proud of our progress, we recognize that challenges remain. The mining industry faces increasing pressure to meet the world's growing demand for critical minerals while mitigating environmental and social impacts. We remain focused on refining our approach, listening to our stakeholders and continuously aiming to invest in responsible mining operations.

We are committed to continuing our journey toward a sustainable and resilient future. We will continue to explore new opportunities to encourage innovation, ensure the safety and well-being of our employees and assist the Operators, where appropriate, with their sustainability efforts.

Thank you for your continued support and confidence in our company.

1In this report, we segment scope 3 corporate emissions into those arising from our corporate activities (which we refer to as our scope 3 corporate emissions) and those of our portfolio Operators (which we refer to as our scope 3 investment emissions). We do this because as a passive investor, we do not have direct influence or control over the Operators' emissions but do manage and assert more control over our own direct footprint. Our scope 3 corporate emissions are largely those associated with business travel and employee commuting.

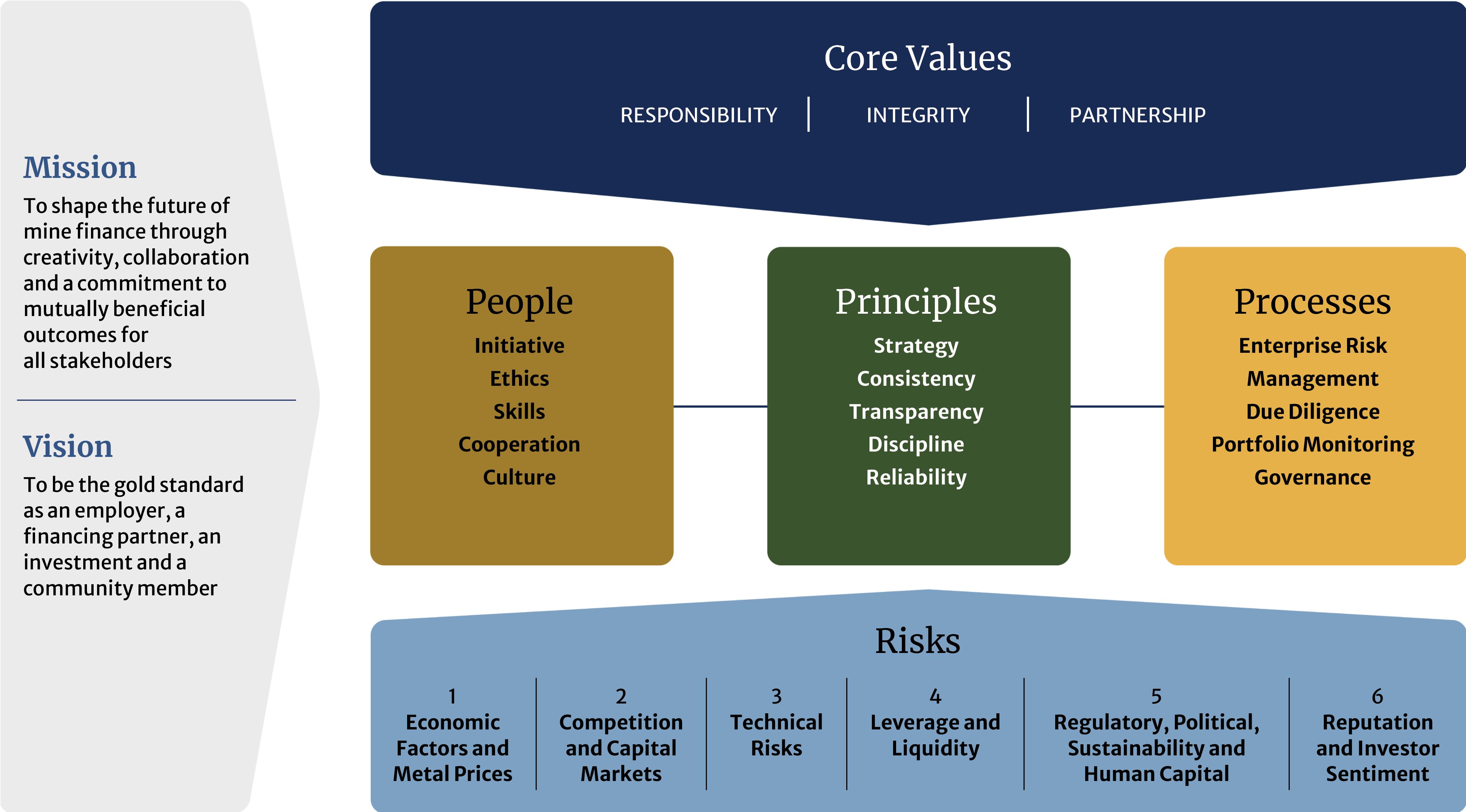

Royal Gold is committed to conducting business with discipline, consistency, strategic focus, transparency and reliability, integrating these values into every aspect of our operations as reflected in our Vision, Mission and Core Values. Our conduct and efforts continue to contribute to a sustainable and responsible business approach while guiding the way forward on People, Principles and Processes.

Royal Gold aspires to be the gold standard in everything we do, and we operate in alignment with the following Vision, Mission and Core Values that are shared throughout the Company.

Executive Director, Boys & Girls Club of Winnemucca

"Royal Gold’s donation to two of our Boys & Girls Club locations has not only helped extend childcare hours for working families but also contributed to the construction of a commercial kitchen that provides nourishing meals for children. This contribution is an investment that aims to build stronger and more sustainable communities."

Educating the industry’s next generation of mining leaders is a priority for Royal Gold, and we are committed to funding scholarships that support mining-related education. We recognize our responsibility to contribute to resource development in our sector, especially given that we expect workforce shortages to increase over time.

...

Learn More >

Royal Gold pledged $1 million in 2024 (over the next five years) to support the revitalization of the Gems and Minerals Hall at the Denver Museum of Nature & Science (DMNS).

Learn More >

Royal Gold partnered with two facilities operated by the Boys & Girls Club of Truckee Meadows in Nevada, U.S. in 2024. The Boys & Girls Club is a registered charitable organization that serves nearly 14,000 youth in more than 50 locations across Nevada, specifically the communities of Reno, Sparks, Fernley, Ely, Tonopah, Panaca and Winnemucca.

...

Learn More >

S&P Sustainability Score

2023: 31, 2022: 34, 2021: 21

MSCI

2022: AA, 2021: AA, 2020: A,

2019: A

Sustainalytics

2023: 9.7, 2022: 9.1, 2021: 18.7, 2020: 22.8, 2019: 23.4

ISS ESG Corporate Rating

2023: C-, 2022: C-, 2021: C-,

2020: C-